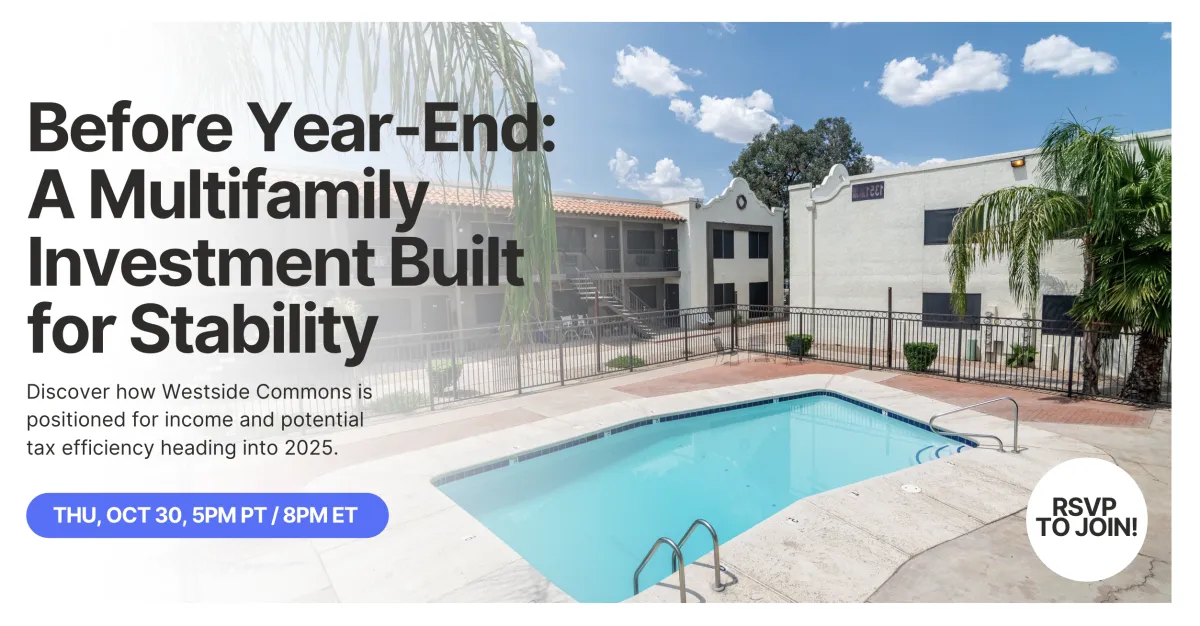

Invest in Westside Commons: A Stabilized 84-Unit Multifamily in Tucson, AZ

A rare opportunity to invest in a fully renovated, cash-flowing multifamily property in Tucson Arizona's thriving market.

Invest Now

Fully Renovated and Cash Flowing

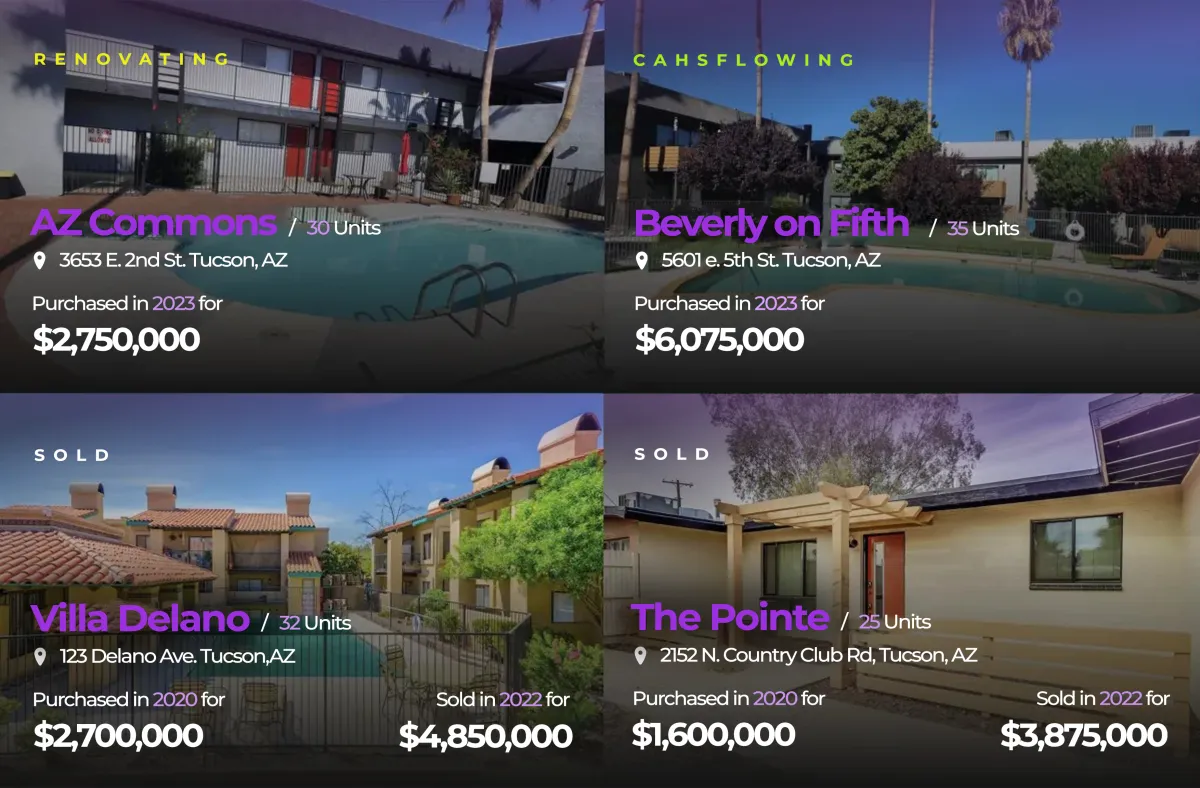

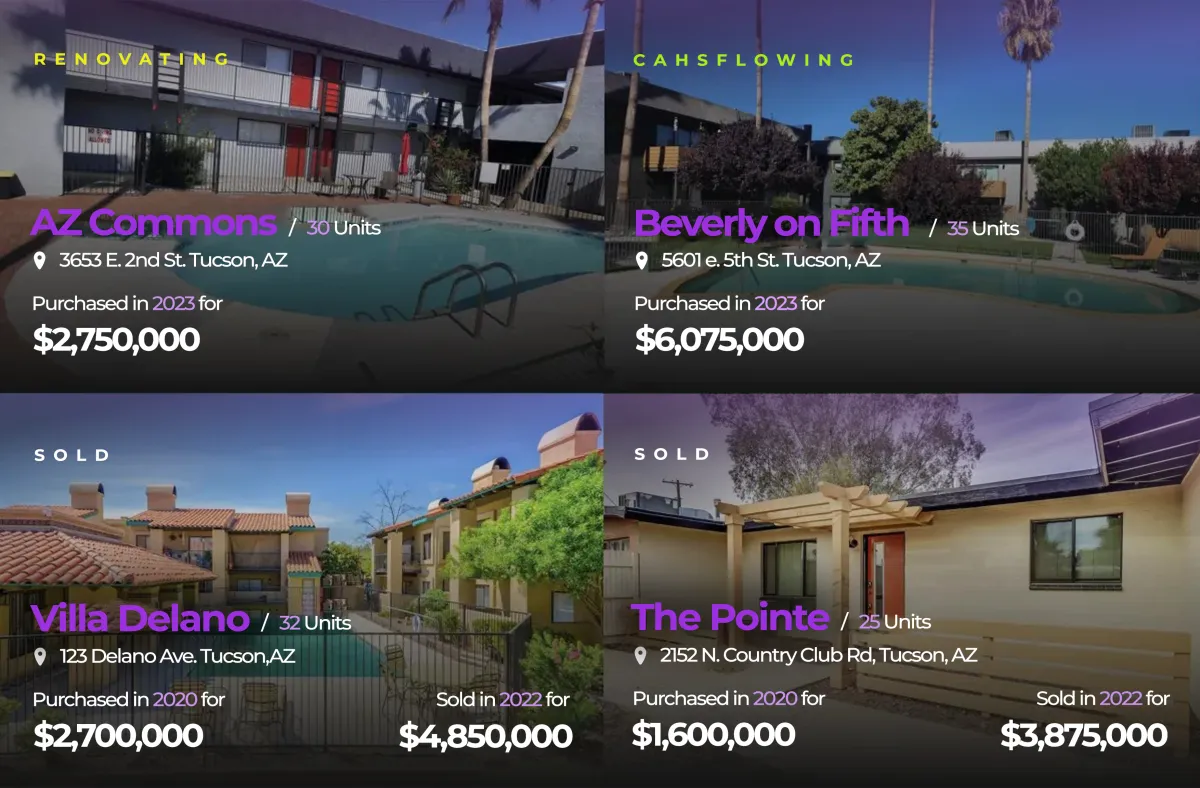

Proven Sponsor with 7 Acquisitions in Tucson

9.07% Ave Cash-on-Cash, 8% Preferred Return

Fully Renovated and Cash Flowing

Proven Sponsor with 7 Acquisitions in Tucson

10-12% Cash-on-Cash, 8% Preferred Return

Upcoming Webinars

Join us weekly for live deal updates and expert-led sessions on key investor topics.

How The Right Accounting Team

Protects & Propels Your Capital

Wednesday, May 14th at 4:00PM PT

Discover how disciplined accounting teams uncover risks early and drive confident capital deployment!

Crystal DiJoseph

CPA, Partner & Co-founder, ONE10, LLC

Deep expertise in real estate finance and building accounting systems that scale

JOIN OUR LIVE BRIEFING ON OPERATIONAL ACCOUNTING WITH A SEASONED FINANCE EXPERT.

Can’t attend live? Register to receive the replay.

Avoiding Hidden Landmines: The Investor’s Guide to Property Surveys

Thursday, May 15th at 4:00PM PT

Avoid costly surprises by understanding how surveys protect your capital—and what happens when you skip them!

DAVID BREWER

Director of Business Development, NV5

Expert in ALTA Surveys, Zoning, and CRE Due Diligence

JOIN OUR LIVE SESSION TO UNDERSTAND HOW PROPERTY SURVEYS CAN MAKE OR BREAK YOUR DEAL WITH A SURVEY AND DUE DILIGENCE EXPERT.

Can’t attend live? Register to receive the replay.

Replay Hub

Masterclass Archive

Westside Commons Overview

Benefits of Cost Segregation

The Importance of the Right SEC Attorney

Upcoming Webinars

Join us weekly for deal updates and live Q&A

Thursday, October 30th

at 5pm PT / 8pm ET

FOR NON-ACCREDITED INVESTORS

Friday, June 20th at 12PM PT

Meet Your Deal Sponsors and hosts

Danny Flores

Principal, Prime Capital Investments

Lead Sponsor with 31 Acquisitions, 9 in Arizona, and 3 successful exits in Tucson, Arizona.

Hitomi Yasuda

Principal, Neko Partners

Co-Sponsor providing expertise as an underwriting risk analyst and investor relations.

Don't miss this opportunity to speak directly with the deal sponsors to have your questions answered.

Can’t attend live? Register to receive the replay.

Replay Hub

View Past Webinars

Westside Commons Overview

Benefits of Cost Segregation

The Importance of the Right SEC Attorney

Westside Commons - From Our CFO's Perspective

Using IRA Funds to Invest in Real Estate Projects

Upcoming Week's Webinar

Join our expert-led session on cost segregation strategles

Cost Segregation

Tuesday, May 6th at 4:00PM PST

6

24

37

X

6

Leam how cost segregation studies can accelerate depreciation and maximize tax benefits for your real estate investments

Tyler Miller Deognationt

Скрегинное ветва witte prouded in template

60 minutec+Q&A with expert

Extracting text.....

Register Now

Guest Speaker

Nate Dodson, JD, MBA

Principal Attorney, Crowdfunding Lawyers

17 years guiding real-estate syndicators and business owners through Reg D, Reg CF, and Reg A+ offerings.

Why legal structure matters for investors—and how it protects your capital

Ask about our 7 past acquisitions in this submarket.

How legal clarity helps you evaluate risk and make more confident decisions

What questions to ask before investing in any private offering

Discover a Rare Combination of

Stability & Upside

Westside Commons is a 1983, 84-unit, fully renovated multifamily community located near major employers, St. Mary's Hospital, and the University of Arizona. With ~95% occupancy and extensive modern updates, the property provides cash flow from the very first quarter, plus additional upside through modest rent growth and operational improvements.

Purchase Price

$10.75M ($128K/unit)

Agency Financing

~70-75% LTV at ~5.7% interest

Equity Raise

$4.4M (Accredited & Non-Accredited Investors)

Westside Commons is Fully Renovated

Completed Exterior Improvements

Completed Interior Renovations

Property Details

Projected Returns

Property Type

Multifamily (84 Units)

Occupancy

~95%

Recent Renovations

~$2M Investment

Hold Period

5 Years

Location

Near St. Mary's Hospital and University of Arizona, Tucson

Projected Returns

Preferred Return

8%

Average Cash-on-Cash

9.07%

Targeted IRR

17.27%

Distribution Frequency

Quarterly

First Distribution

First Full Quarter Post-Closing

Tucson's Thriving Submarket

Tucson's job market is expanding, driven by healthcare, aerospace, and university-related growth.

Key Economic Drivers

St. Mary's Hospital - Major Healthcare Employer

University of Arizona - 45,000 Students and Staff

Downtown Business District - Growing Tech Hub

Raytheon Technologies - Major Aerospace Employer

High demand for quality workforce housing ensures strong tenant retention.

Rental increases projected over time due to market growth.

Strategic location near major employers and the University of Arizona.

Proximity to St. Mary's Hospital provides stable tenant base.

Tucson Market Highlights

0.7%

Annual Rent Growth

4.2%

Annual Rent Growth

88.7%

Market Occupancy

0.7%

Population Growth

3.1%

Population Growth

1.02%

Job Growth

Cash Flowing & Prudent Value Creation

Our business plan focuses on operational improvements and strategic financing to maximize returns while maintaining stable cash flow.

Fully Renovated Asset, No Heavy Lifting

The previous owner invested roughly $2M in interior and exterior renovations—avoiding the typical "value-add" construction risk.

→ Day-one occupancy (~95%) means consistent

income from the start.

→ Modern updates already completed,

reducing renovation risks.

→ Focus on operational improvements rather

than construction management.

→ Immediate cash flow without waiting for

renovations to complete.

Sponsorship Team

Hitomi Yasuda

Principal, Neko Partners

With over 25 years in international sales, product management and merchandise planning experience, Hitomi has always had an entrepreneurial spirit with a strong work ethic and analytical mind. For the past 6.5 years, she has supported several partnership where she has underwritten 1,500+ multifamily and commercial syndication deals across 10 states, with property sizes ranging from $1.5MN to $103MN portfolios.

Conservative in her underwriting approach, Hitomi prioritizes investor protection and return integrity over 5–7 year hold periods, while remaining mindful of community impact.

Neko Partners is proud to be partnering with Prime Capital Investments on this opportunity. Led by Danny Flores, PCI is a proven operator in Arizona, with extensive experience in the Tucson market.

Prime Capital Investments

Proven Experience: Multiple profitable exits in Tucson, often exceeding proforma projections.

Local Team: Seasoned property management partner with in-depth market knowledge and operational efficiency.

Track Record: 7 successful acquisitions in the Tucson market with consistent returns for investors.

Timeline & Next Steps

Secure your position in this limited investment opportunity before the funding deadline.

Funding Deadline

June 9, 2025

All Investor Funds Must Be Received

Closing Date

June 18, 2025 (Target)

How to Participate

1

How to Participate

Sign up for a webinar or schedule a 1:1 call.

2

Go to Investor Portal to Review Docs

Access Private Placement Memorandum, Company Operating Agreements, and the Subscription Agreement.

3

Commit & Fund

Secure your allocation before the raise is fully subscribed.

Invest Now

Frequently Asked Questions

Get answers to common questions about investing in Westside Commons.

Do I need to be an accredited investor?

This offering is being conducted in accordance with Regulation D Rule 506(c) for accredited investors and Regulation Crowdfunding (Reg CF) for non-accredited investors.

When I will receive distributions?

We plan on sending quarterly distributions starting the first full quarter post-closing.

What if I can't attend a webinar?

Each session is recorded. We'll email the replay link to all registrants.

How do I get more details about the property?

Visit the investor portal and book a call if you have any questions.

Ready to secure your allocation?

Book a call with Neko Partners to secure your spot in Westside Commons.

Invest Now

This presentation is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy securities. Any forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Potential investors should review all offering documents and conduct their own due diligence before investing.